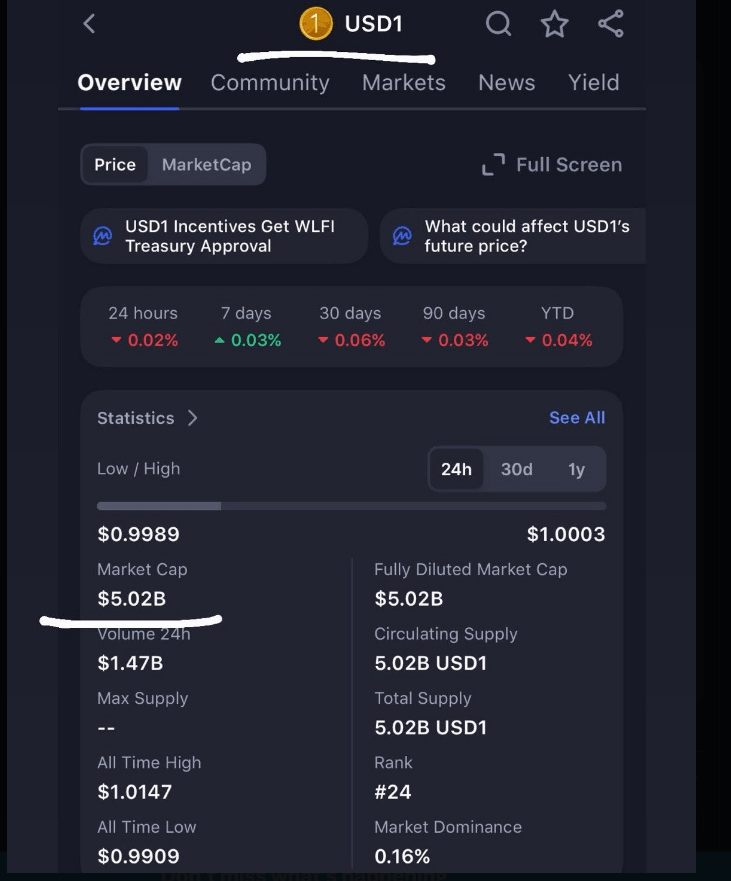

USD1 has pushed past a $5 billion market cap, a rapid climb that has attracted wide attention across crypto markets. Reports say the stablecoin, issued by World Liberty Financial, now ranks among the largest dollar-pegged tokens.

Trading has stayed close to the $1 peg even as overall market interest spiked. Some exchanges have added new pairs and incentives, which helped volume swell over recent weeks.

Market Milestone Reached

Reports note that members of the Trump family celebrated the milestone on social feeds, calling USD1 “Built in America.” US President Donald Trump was quoted praising the token as an example of American engineering and finance coming together.

That message boosted mainstream interest and brought a fresh round of headlines. At the same time, other tokens linked to the same circle have fallen sharply, showing mixed fortunes across related projects.

USD1 just reached a $5B market cap.

Built in America, designed for real-world scale, and adopted by serious institutions.

This is what happens when you focus on infrastructure over noise. 🇺🇸🦅☝️ @worldlibertyfi pic.twitter.com/bdYfVxVi8J

— Donald Trump Jr. (@DonaldJTrumpJr) January 28, 2026

How The Coin Grew

Liquidity and listings matter. Based on exchange disclosures, USD1 gained listings and earning programs that made the stablecoin easier for traders and institutions to hold massive balances.

This lowered technicalities for movement and helped the coin’s market valuation rise quickly. On-chain activity shows large inflows at times, while prices stayed steady around the dollar peg.

Reports say some big holders moved funds between platforms, which pushed reported market cap numbers higher on public trackers.

Trust And Regulation

There remain some queries over transparency in reserves, along with some queries from banking regulators and observers about a clearer audit and a specific banking arrangement for issuance.

According to reports, the issuer has applied for charter and is taking steps to be in compliance with US requirements. While this has reassured some of the investors, others claim they still need proof to gain their trust.

The regulatory angle is shaping future plans for expansion and institutional use.

Comparisons And Contrast

USD1’s rise has not lifted every project tied to the same names. One meme token linked to the group dropped more than 90% from its peak.

Investors are splitting between stable, utility-style holdings and speculative bets that have lost steam. Reports say the stablecoin’s steady peg made it attractive to users fleeing volatility elsewhere.

This split highlights a broader shift: some money prefers a token that holds value closely to the dollar, while other funds chase quick gains.

Featured image from Unsplash, chart from TradingView